Rising Remittances Reflect Growing Economic Optimism in Pakistan

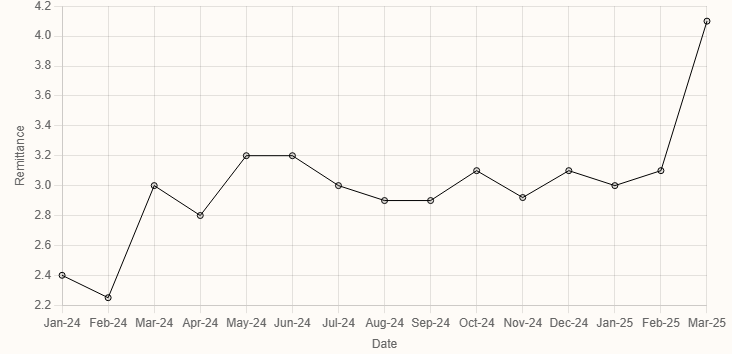

Pakistan’s journey toward economic resilience and stability is experiencing a positive turn, driven significantly by the rising wave of remittances from overseas Pakistanis. Traditionally, exports and remittances serve as the twin engines of economic growth for any country, but in developing economies like Pakistan, foreign inflows through remittances often act as a critical lifeline. The latest data signals a robust and encouraging trend, with remittances reaching an all-time high of over $4 billion in March 2025, as reported by the State Bank of Pakistan. This impressive figure not only marks a 37% increase from previous months but also stands as the highest single-month figure in the nation’s history. It reflects not only the economic resilience of Pakistan’s expatriate community but also their growing confidence in the country’s improving financial management and governance.

The current momentum in Pakistan’s economy is visible across various indicators. Remittances for the first nine months of the fiscal year 2024–2025 have totaled an astounding $28 billion, representing a 33.2% increase compared to the $21.04 billion received in the same period last year. These inflows have significantly bolstered the country’s external account, offering a cushion against global economic shocks and reducing the pressure on Pakistan’s foreign reserves. This shift is crucial, as it highlights a growing trend of financial sovereignty. Pakistan is increasingly relying on internal support rather than external borrowing to meet its financial needs.

The economic impact of rising remittances is multifaceted. On the one hand, these inflows support millions of households directly, increasing their purchasing power and enabling higher domestic consumption. On the other, they strengthen the broader macroeconomic framework by stabilizing the currency, helping to manage inflation, and balancing the current account. According to financial expert Sana Tawfik, the record inflows are likely to result in a current account surplus of around $700–900 million for March 2025. This surplus is not merely a statistical improvement, rather it reflects real progress in achieving financial discipline, stability, and long-term economic planning.

At the same time, Pakistan’s financial markets are responding positively to the changing economic landscape. The Pakistan Stock Exchange (PSX) has been riding a bullish trend, with the KSE-100 Index surpassing the 119,421.81-point level during intra-day trading. The recent increase of 689.71 points underscores growing investor confidence, both from within the country and internationally. This trend is a strong signal that the business environment is stabilizing and that economic reforms are beginning to bear fruit. As the PSX continues to perform well, it attracts more capital inflows, fueling further investment and expansion opportunities.

This convergence of high remittance inflows and a bullish stock market indicates that Pakistan is entering a new phase of economic optimism. The depreciation of inflation to a record low of 1.5% in 2025 further confirms the effectiveness of the country’s fiscal and monetary policies. With inflation under control and the rupee stabilizing, the economy is regaining the trust of both consumers and investors. These developments send a strong message that Pakistan’s economy is no longer teetering on the edge but is instead moving toward sustainable recovery and inclusive growth.

The implications of such developments go beyond numbers. They touch the daily lives of millions of Pakistanis who benefit from the economic activity fueled by remittances. Whether it is through increased household spending, better access to services, or new employment opportunities created by investments, the positive effects of remittances are widespread. Moreover, these inflows enable the government to allocate more resources toward public welfare, infrastructure, and development without relying excessively on international financial institutions.

From a strategic standpoint, the remittance surge strengthens Pakistan’s case on the global economic stage. With a better current account position, reduced need for foreign loans, and growing forex reserves, Pakistan is asserting its financial independence. Global agencies are taking note. Moody’s recently upgraded Pakistan’s credit rating, citing improved fiscal credibility and the country’s ability to meet its external financing needs. Such recognition enhances the country’s image as a reliable destination for investment and trade.

Furthermore, rising remittances are not just a financial story; they are a testament to the faith of overseas Pakistanis in their homeland. Despite global uncertainties, expatriates continue to send their hard-earned money back, signaling a deep-rooted belief in Pakistan’s potential. This trust is invaluable and should be nurtured through transparency, ease of banking channels, and inclusive economic policies that benefit both senders and recipients.

The current upward trajectory must be maintained through sustained reforms and prudent economic governance. While the present indicators are promising, long-term economic sustainability will require continued focus on structural improvements, strengthening institutions, and ensuring that economic gains are equitably distributed. The government’s role in facilitating smoother remittance flows, reducing bureaucratic hurdles, and enhancing the ease of doing business remains crucial.

In conclusion, Pakistan’s economic outlook has taken a positive turn, driven largely by record-breaking remittance inflows and growing investor confidence. These developments reflect a nation steadily transitioning from economic uncertainty toward financial self-reliance and sustainable growth. As Pakistan continues to capitalize on this momentum, it is e