Middle East War and Its Global Impact

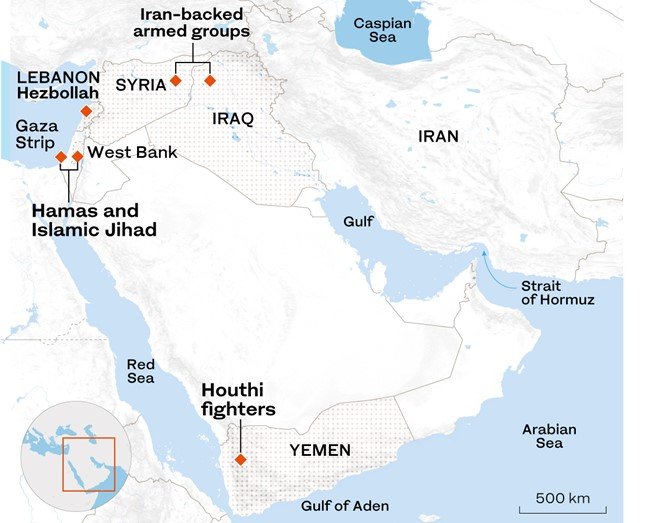

The year 2025 has proven to be a pivotal chapter in the modern history of the Middle East, marked by unprecedented violence, geopolitical friction, and humanitarian disaster. As global powers recalibrate their roles in the region and longstanding conflicts reignite with new intensity, the repercussions have rippled far beyond national borders shaking the foundations of international diplomacy and disrupting global economic stability. Middle East War From the devastating war in Gaza and border clashes in Lebanon and Syria to renewed violence in Yemen, the Middle East has become the epicenter of a crisis that is reshaping alliances, testing humanitarian limits, and igniting widespread concern among world leaders and citizens alike. With over 51,000 lives lost in Gaza alone and inflation skyrocketing across multiple nations, 2025 has delivered a sobering reminder of the fragile nature of peace in the region.

Since October 2023, the Gaza Strip has endured relentless conflict. By April 2025, over 51,000 Palestinians had lost their lives, with women and children comprising more than half of the casualties. The Israeli military’s operations, including airstrikes on medical facilities like the Kuwaiti Field Hospital in al-Muwasi, have exacerbated the crisis, leading to widespread condemnation from international organizations.

A ceasefire agreement, effective from January 19 to March 18, 2025, facilitated the exchange of hostages and prisoners between Israel and Hamas. However, the truce was short lived, and hostilities resumed, plunging Gaza back into turmoil. In March 2025, clashes erupted along the Lebanon Syria border, particularly around Al-Qusayr and Qasr.

The ongoing Middle East crisis of 2025 has unleashed a cascade of economic disruptions that are being felt far beyond the region’s borders. With multiple conflicts unfolding simultaneously from Gaza and Yemen to the Lebanon Syria border markets worldwide have responded with volatility, uncertainty, and in some sectors, outright panic.

One of the most immediate and profound effects has been on global energy prices. The Middle East remains a critical hub for oil and gas exports, and renewed hostilities in key areas have led to serious concerns about supply disruptions. The Centre for Economics and Business Research (CEBR) has projected that an escalated and prolonged war in the region could slash global GDP by as much as £311 billion in 2025 alone. This potential loss stems primarily from rising oil prices, which have surged due to instability in shipping lanes and attacks on infrastructure particularly in the Red Sea and Persian Gulf, where Houthi-aligned forces have targeted international vessels.

Israel, at the epicenter of the conflict, is facing severe domestic economic consequences. According to the same CEBR report, Israel’s GDP is expected to contract by up to 12% by the end of 2025. The reasons are multifaceted the ongoing war with Hamas has led to significant destruction of infrastructure, a steep decline in tourism, a reduction in foreign investment, and immense public spending on military operations and civilian support. Major sectors such as tech, agriculture, and construction have been disrupted due to workforce mobilization and security threats, while consumer spending has plummeted amid widespread insecurity and displacement.

In neighboring countries, the ripple effects continue to grow. Egypt and Jordan, already under financial strain, have been forced to reallocate budgets to handle refugee influxes and security concerns. Lebanon, entrenched in political and economic instability, has seen further deterioration in investor confidence and currency valuation as border tensions with Syria and Israel intensify.

On a broader scale, the crisis has also affected the global fight against inflation. Central banks in the US, UK, and EU have expressed concerns about persistent energy driven inflation, leading to delays in planned interest rate cuts and tighter monetary policies. These actions, while aimed at stabilizing inflation, could dampen growth in both developed and emerging markets already struggling with high debt levels and fragile recoveries.

Global trade has also taken a hit. The World Bank and IMF have both issued warnings about slowing trade volumes and the risk of stagflation particularly if the crisis extends into 2026. Fragile supply chains, especially those reliant on Middle Eastern ports and shipping routes, are experiencing renewed strain, which is being felt across industries from automotive manufacturing to food supply.

Yemen witnessed intensified conflict as the US, UK, and Israel launched coordinated airstrikes against Houthi targets in response to attacks on international shipping lanes. By mid-April 2025, these strikes had resulted in at least 123 deaths, including 80 fatalities from a single attack on the Ras Issa fuel port. The escalation underscored the broader geopolitical tensions involving Iran backed groups and Western powers. The conflicts have severely impacted the Middle East’s economies.

Inflation soared to alarming levels 140% in Gaza, 119% in Sudan, 79% in Syria, and 29% in Iran. Yemen’s GDP per capita has more than halved since 2015, with the Yemeni rial losing 50% of its value in 2024. Public debt has also surged, with Egypt’s debt reaching 91% of its GDP and Tunisia’s at 82%. The Middle East crisis has had far-reaching economic consequences. The Centre for Economics and Business Research (CEBR) estimated that an escalated war in the region could reduce global GDP by £311 billion in 2025, primarily due to increased oil prices. Israel’s economy alone is projected to contract by 12% of its GDP by the end of 2025.

The Middle East crisis of 2025 has underscored the region’s volatility and the global ramifications of its conflicts. The humanitarian toll, economic disruptions, and geopolitical tensions highlight the urgent need for sustained international engagement and comprehensive peace initiatives to stabilize the region and prevent further escalation.