Adani Enterprises Faces Continued Decline Amid Broader Market Challenges

Adani Enterprises Faces Continued Decline Amid Broader Market Challenges

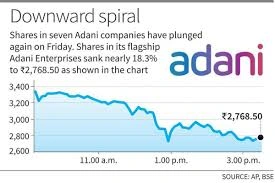

Adani Enterprises has witnessed a sustained downturn in its stock price, falling for four consecutive trading sessions and significantly underperforming its sector. As of today, the stock dropped 3.19%, reaching an intraday low of ₹2,176.05, and continues to trade below all key moving averages—5-day, 20-day, 50-day, 100-day, and 200-day—signaling a bearish trend in both the short and medium term.

In contrast, the broader Indian market, represented by the Sensex, also saw a decline today, falling by 429.81 points to 80,048.20, a drop of 0.71%. However, unlike Adani Enterprises, the Sensex shows a year-to-date gain of 2.44%, while Adani’s YTD performance reflects a decline of 13.84%.

Performance Snapshot:

- Stock Price Today: ₹2,178.10 (–₹71.50 / –3.18%)

- Volume: 14.85 lakh shares traded (+214.72% vs avg)

- 4-Day Drop: –7.8%

- 1-Year Return: –31.17%

- 5-Year Return: +1,030.45%

Key Concerns:

- Poor Management Efficiency: Return on Capital Employed (ROCE) at 6.91%, indicating low capital profitability.

- Weak Return on Equity (ROE): Averaging just 7.07%, reflecting poor returns for shareholders.

- High Debt Burden: Debt to EBITDA ratio stands at 6.41x, showing a low ability to service debt.

- Negative Profit Trend:

- PAT: ₹734.41 crore (–28.8% vs 4Q average)

- Interest Expense (9M): ₹4,973.18 crore (+39.97%)

- Operating Cash Flow: ₹4,513.10 crore – the lowest in years

- Valuation Pressure: Despite a ROCE of just 7.6%, the company trades at a relatively expensive 2.6x EV to Capital Employed, raising valuation concerns.

Despite a stellar 5-year gain of over 1,000%, the company now faces a challenging financial and operational environment, with mounting debt, falling profits, and weakened investor confidence.

Stay tuned with One Nation Voice for real-time business coverage and stock updates.