Breaking the Aid Cycle Towards Fiscal Independence & Reform

The Dependency Burden

This is an economic story of Pakistan, and one cannot underscore foreign aid and loans. External financing has been increasing to reach 131 billion by June 2025 according to State Bank of Pakistan. It is one of the lowest in South Asia with revenue collections of only 10.6 percent compared to GDP. There is a large scale dependency on borrowings, and the average fiscal deficits are 7 percent of the GDP each year. Pakistan is dependent on IMF bailout such as the $7.4 billion Extended Fund Facility agreed upon in 2024, billion Chinese bilateral loans, and Saudi and UAE assistance. To service its debts alone took up $18 billion in the 2024-25 budget just short of 45 percent of the total outlays. This is not something but a requirement to sovereignty. The Pause allows cutting PMU reliance and PM27 billion financing growth assume greater authority over the country in CPEC and other domestic initiatives.

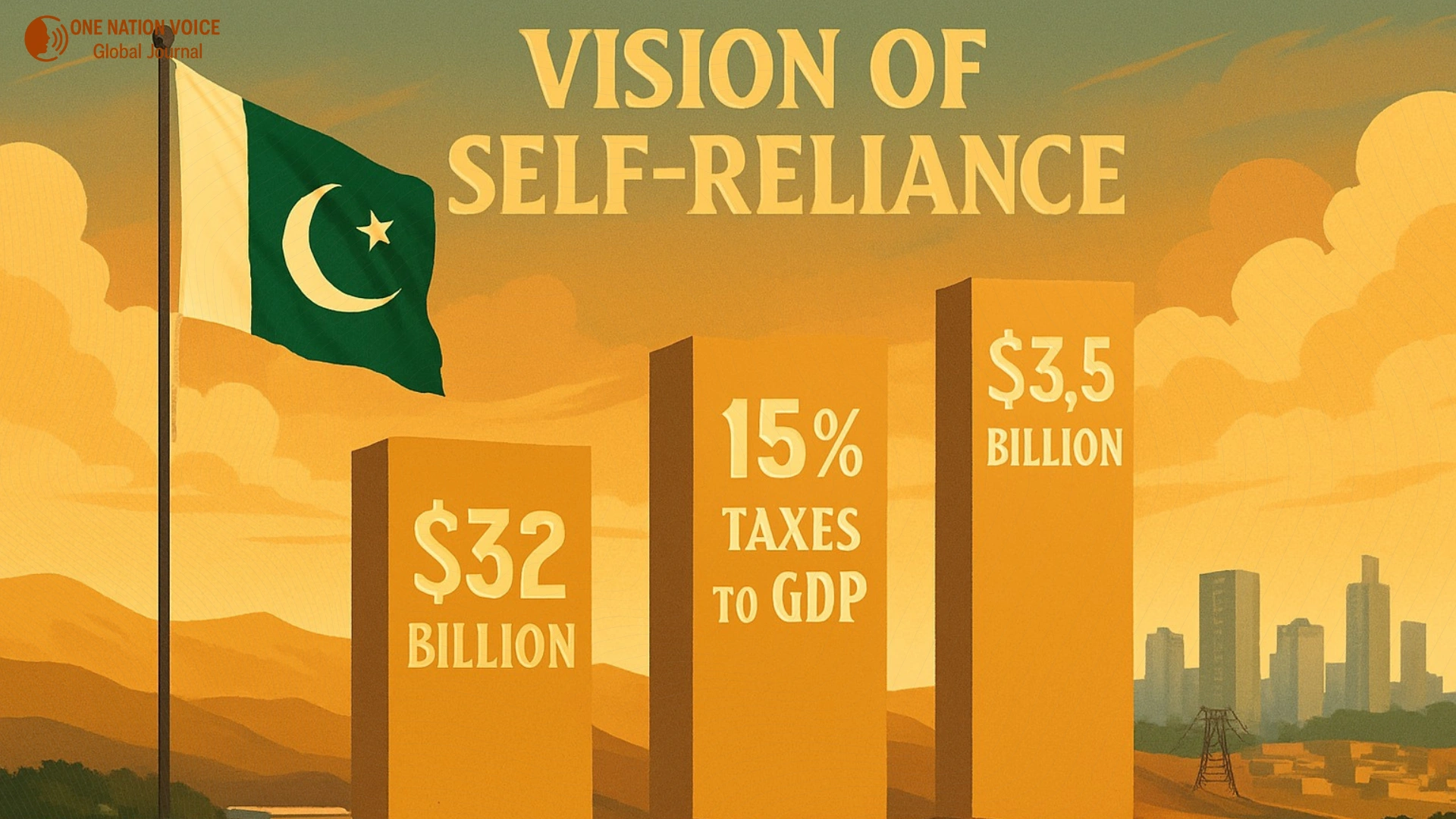

Vision of Self Reliance

Pakistan has also to readjust its economic policy towards independence. The state now aims at a 15% ratio of taxes to GDP by 2030 using the remittances which amount to $32 billion to develop an independent economy. Tapping of these local resources has the potential to liberate this country out of the laces of bail out. Tax reforms and subsidy reduction as well as $3.5 billion domestic resources attracted to pursue a sustainable future. The strategy is in tandem with international best practice and puts the country on a trajectory where foreign borrowings are not lifeline.

Notably, Only 5.8 million citizens are tax filers currently. That will be geared to reach 10 million by 2027. Simpler budgets and a broader tax base make 131 billion dollars in debt, an opportunity to achieve growth.

Track and trace systems such as those implemented by the FBR and anti-corruption enhancements could potentially increase integration and tax collections by up to one quarter. Digital tax systems and smart fiscal policies can unlock the potential of finding 10 billion extra dollars and thereby allowing autonomous growth.

Combating Corruption and Waste

Indeed, Pakistan has become a victim of the corruption culture, and it loses 2.5 million US dollars yearly to corruption as reported by Transparency International. Recovery of $2.5 billion wasted in corruption pays for school and infrastructure and funds a way out of poverty and full independence. This amount, when well-managed, will radically alter health, education and connectivity. The existing scheme of unmonitored leakages is financially nonviable. Fiscal policy should become anti-corruption reformed.

Repurposing the Taxpayer

The other burning issue is misconstrued funding priorities. It costs Pakistan billions to subsidize nonproductive industries. Prudent policy reform is making $3.5 billion worth of energy subsidy cuts. The savings on subsidies increased educational expenditure by 20 percent in 2025 and overcome the problem of 23 million children failing to attend schools. The current focus of resources may need to be changed as an economic requirement and a social one as well, because it is cheaper to educate the citizen than it is to keep him dependent upon the government through subsidies and other similar patterns of employment or welfare. Each child who attends school is one step further to breaking further into generational poverty.

Energy and SOE Reform

The circular debt in the energy sector has been choking with a figure of $15 billion. This burden can be released by privatizing state owned enterprise and governance reforming. Privatization of SOEs and the cutting of 15 billion circular debt offloads the energy sector burden on the public finances. The rest of the economy cannot stabilize without fixing energy. When reforms are implemented in this sector it will directly lead to savings in terms of the fiscal deficit. It will provide the scope of growth oriented expenditure.

The Place of Remittances

Remittances have turned out to be a major lifeline to the economy with an increase of 7% to 32 billion in 2024-25 . This money may be directed to investment instead of pure consumption. This inflow can be channeled to housing, infrastructure and entrepreneurship through structured policies.

Pakistan is aiming towards having 15 percent tax to GDP ratio by 2030 and using the remittance to create an economy that is self reliant.

Lessening IMF Dependence

Bailouts have conditions which do not leave much space in setting policy. Pakistan cannot use IMF packages as the perpetual means. Dependence on IMF and bilateral loans will not be an easy task to cut but gradual reforms make it possible.

The inclusive fiscal policies guarantee that growth reaches 40 percent of the population that lives below the poverty line. And minimizes risks of social unrest usually caused by IMF conditionality.

Direction of Frustration of Fiscal Sovereignty

These reforms are aimed at reducing the debt to GDP rate to 60% by the year 2030 starting at 70 percent at present. The result is to finance education, health, infrastructural development and to make Pakistan a self-sustaining regional center. This strategy includes tax reforms, reduction of subsidies and governance repair. Transparency programs and digital tools make things accountable.

There is an opportunity to chart Pakistan a new course. The domestic resources are being marshalled through tax reforms and subsidy cuts of 3.5 billion toward a sustainable future. The re-diversion of the $2.5 billion lost corruption changes lives and cuts dependency. Slimmed down budgets and a larger tax base leave room to convert debt to opportunity to the tune of $131 billion. Privatization and energy reforms curb the circular debt and free growth. With these measures Pakistan can get out of the aid circle, reinforce sovereignty and have a sovereign economic future.

Disclaimer:

The views and opinions expressed in this article are exclusively those of the author and do not reflect the official stance, policies, or perspectives of the Platform.