Disney Closes Deal Merging Hulu Live TV With Fubo

Disney Finalizes Hulu + Live TV Merger With Fubo, Creating Second-Largest U.S. Virtual Pay-TV Provider

LOS ANGELES – Disney and Fubo have officially closed their merger deal, combining Hulu + Live TV operations with Fubo to form a new streaming powerhouse. Under the agreement, Disney will own a 70% stake, while Fubo shareholders retain 30%, positioning the company as the second-largest virtual pay-TV provider in the United States — trailing only Google’s YouTube TV, which boasts over 10 million subscribers.

The newly merged entity now serves nearly 6 million subscribers across North America, marking a major consolidation in the competitive live-streaming television sector. The U.S. Department of Justice’s Antitrust Division cleared the deal earlier this month, enabling both companies to finalize the merger.

As part of the transaction, Fubo’s advertising sales group will integrate with Disney’s ad sales division, further expanding Disney’s already dominant advertising ecosystem. Despite the merger, both Fubo and Hulu + Live TV will continue to operate as distinct consumer services, offering various subscription plans “from skinny to robust” at competitive price points.

Also Read: Nokia (HLSENOKIA) Valuation in Focus Following $1 Billion Nvidia AI Network Partnership

Additionally, Hulu + Live TV will remain accessible via the Hulu app and continue to be offered as part of the Disney+, Hulu, and ESPN Unlimited bundle, allowing customers access to more than 55,000 live sporting events and entertainment programs.

The new company will benefit from a $145 million term loan Disney has committed to provide in 2026. Both sides expect to realize significant cost and operational synergies through optimized content packaging, advertising, and marketing efficiencies.

Leadership and Board Structure

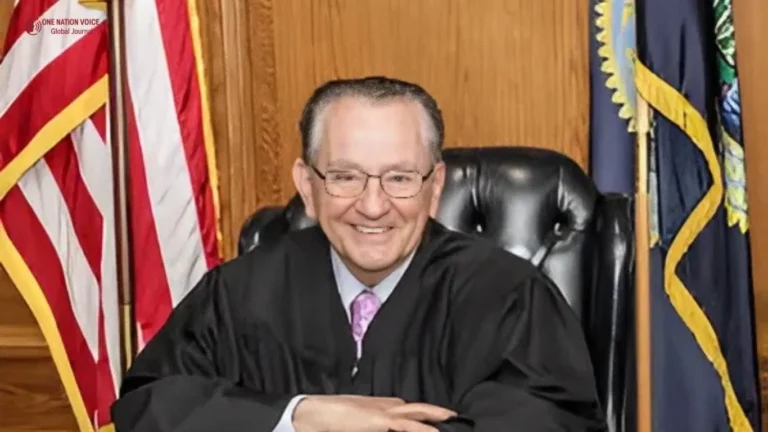

The board will be led by Andy Bird, former Walt Disney International chairman and ex-CEO of Pearson, who will serve as the independent chairman of the combined entity. “Today’s announcement brings together two industry-leading brands and a compelling set of resources uniquely positioned to meet the evolving needs of today’s consumer,” Bird said.

Fubo CEO David Gandler will continue to lead operations. “Together with Disney, we’re creating a more flexible streaming ecosystem that gives consumers greater choice while driving profitability and sustainable growth,” Gandler stated.

Other board members include:

- Daniel Leff, Co-founder of Waverley Capital

- Ignacio “Nacho” Figueras, polo player, entrepreneur, and philanthropist

- Jonathan S. Headley, former Disney SVP & Treasurer

- Jim Lygopoulos, EVP of People & Culture at Disney

- Debra OConnell, President, ABC News Group & Disney Entertainment Networks

- Cathleen Taff, President of Production Services, Disney

- Justin Warbrooke, EVP, Corporate Development at Disney

Following the merger, Fubo’s shares automatically converted to Class A common stock, continuing to trade on the New York Stock Exchange (NYSE) under the ticker FUBO.

The combined company will adopt a new fiscal year ending September 30, with its first full fiscal year concluding on September 30, 2026.

“Fubo’s retail shareholders have been key to our mission from the start,” Gandler added. “This combination delivers the scale, stability, and strategic clarity needed to create lasting value for both consumers and investors — shaping the future of live streaming.”

🔹 5 Key Takeaways

🔹 Disney now owns 70% of the combined Hulu + Live TV and Fubo venture.

🔹 The new company serves 6 million subscribers, second only to YouTube TV.

🔹 Fubo’s ad sales merge with Disney’s advertising division for broader reach.

🔹 The merger unlocks cost, revenue, and operational synergies through Disney’s scale.

🔹 Andy Bird becomes chairman, while David Gandler continues as CEO.