Pakistan Taps Arab Buna Platform for Payments

Pakistan Taps into Arab Buna Platform for Digital Payments

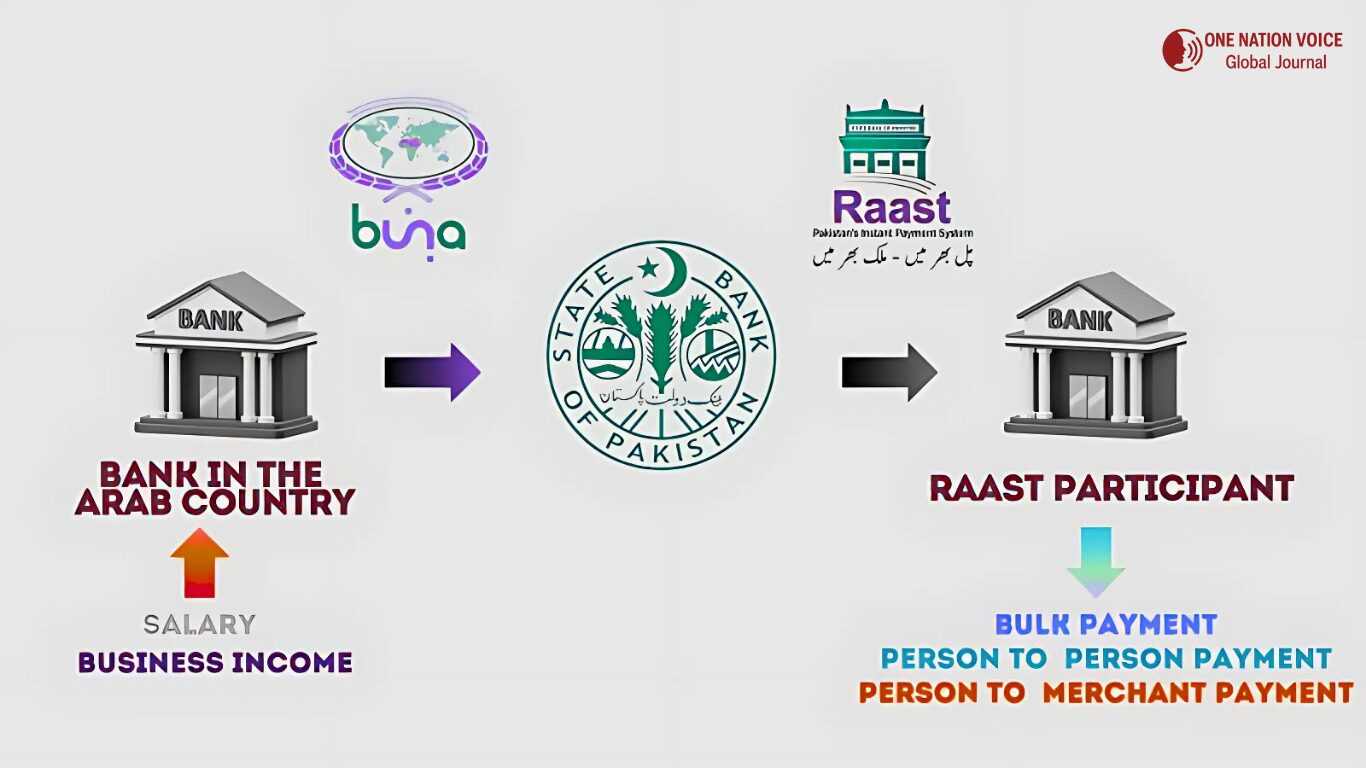

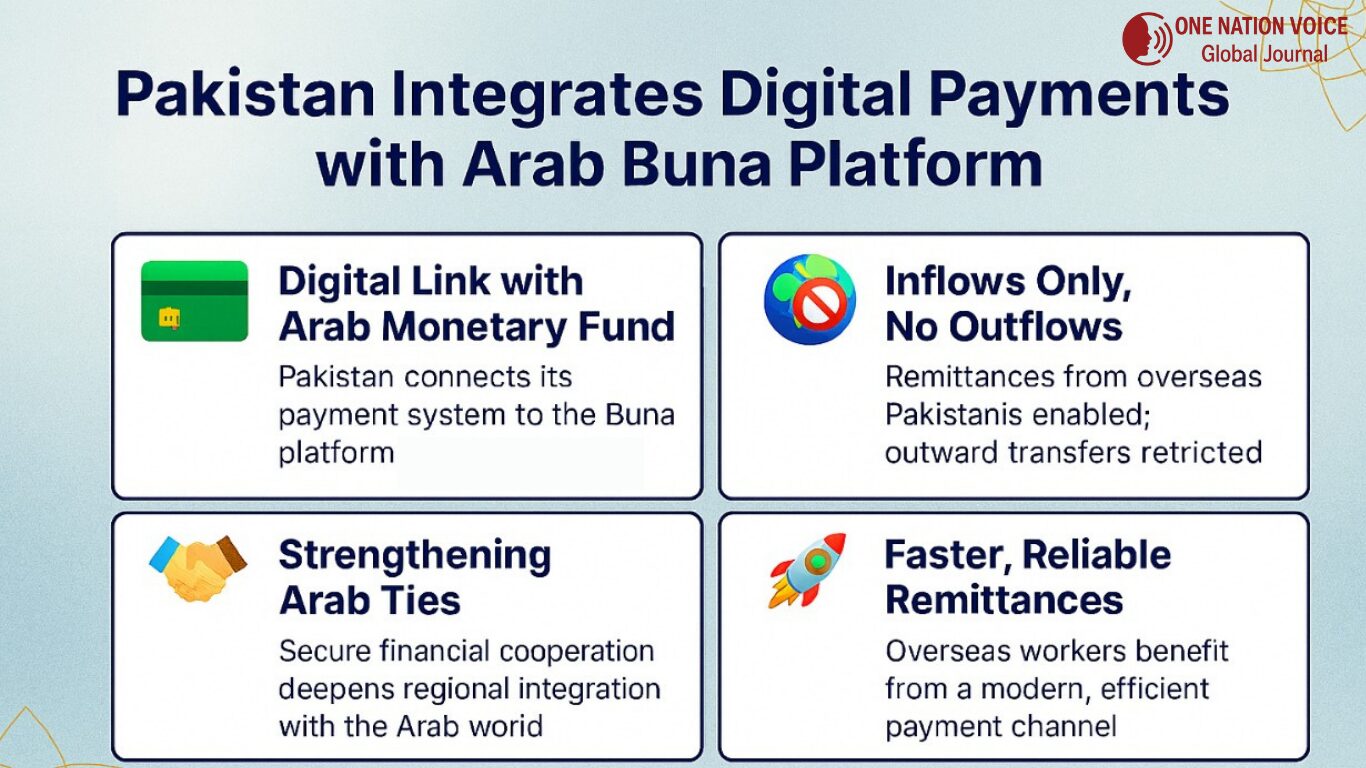

Pakistan has decided to plug its digital payments system into the Arab Monetary Fund’s Buna platform. For most people, the main takeaway is simple that it will be easier, faster, and cheaper for overseas Pakistanis, especially those in Gulf countries to send money home.

But there is a catch worth noting, which is that money can flow in, but not out.

Basically, Buna is a regional digital rails system, set up by the Arab Monetary Fund to handle cross-border payments in a safer, cheaper, and more efficient way. It supports multiple currencies and is already being used across Arab economies. For workers, sending money to their families, it promises speed and fewer fees compared to old school bank routes that often take days and shave off a hefty cut in charges.

Similarly for Pakistan, where remittances are one of the biggest lifelines of the economy, joining Buna makes sense. A huge chunk of the country’s $27+ billion annual inflows come from Saudi Arabia, the UAE, and other Gulf states. Hence, tapping into a system that is purpose built for that region is a logical move.

Why the “Only Inward” Restriction Matters?

The part that makes this deal a bit different is the restriction. The problem is that money can only move into Pakistan, not out of it. Pakistan has been battling foreign exchange shortages, and the government cannot afford big sums leaving the country unchecked.

However, if outward transfers were allowed, it could have opened the door to capital flight or made reserves harder to manage. Thus, by limiting it to inbound flows, like remittances, they are protecting themselves while still reaping the benefits.

What is Buna transfer for People?

In the meantime, for families waiting for money from abroad, the impact could be direct:

- Faster transfers that land in hours instead of days.

- Lower costs compared to traditional money transfer operators.

- Less reliance on informal systems like hawala, which is widely used, sit outside regulation.

Moreover, it also aligns with Pakistan’s broader digital push. The country has already rolled out Raast. So, connecting its instant payment system with Buna down the road could make for a seamless experience for both senders and receivers.

Apparently, this move also says something about Pakistan’s regional strategy. By working with the Arab Monetary Fund, Islamabad is strengthening financial ties with countries where its diaspora lives and works.

It also signals that Pakistan wants to be part of the broader digital payments ecosystem rather than sitting on the sidelines.

At the same time, it highlights the reality that the economy is heavily dependent on Gulf labor markets. Thus, if those economies slow down or change visa policies, Pakistan will immediately face remittances shortages. Buna does not solve that problem, but it does make the existing flows more secure and reliable.

Of course, it is not all smooth sailing. Banks and regulators in Pakistan will need to make sure that their systems are technically compatible with Buna’s. Besides, cybersecurity will be a constant concern. Most importantly, people abroad need to know about this option and trust it. If workers do not hear about it through banks, community networks, or embassies, its adoption could lag.

Moving forward, there is also competition to think about the system. Other countries in the region are joining Buna, and money transfer operators would not just disappear. Pakistan will need to make sure fees stay low and the service delivers on the “faster and cheaper” promise.

Pakistan’s financial condition and Buna Payment system

Furthermore, Pakistan has been in a tight spot financially, with reserves under pressure and IMF negotiations hanging over on policy decisions. So, any move that makes remittance inflows more secure is a win. Besides, remittances are not just about families paying bills, they are a vital source of foreign currency that helps the country keep imports flowing, and the economy afloat.

By focusing only on inward payments, Pakistan is essentially saying “We will take the dollars, but we are not ready to let them leave”.

This might frustrate some businesses in the short term, but from a survival standpoint, it is a cautious compromise.

In short, linking up with Buna is a step forward for Pakistan’s digital payments journey. It gives overseas Pakistanis a stronger, more reliable channel to support their families back home, while giving the state some breathing space in managing its reserves.

Hence, the real test will be in its execution that includes questions like how quickly banks integrate, how much awareness is raised, and whether the system beats the old ways in terms of cost and convenience. If those pieces fall into place, this could quietly become one of the most important financial moves that Pakistan has made in recent years.

The views and opinions expressed in this article are exclusively those of the author and do not reflect the official stance, policies, or perspectives of the Platform.

One thought on “Pakistan Taps Arab Buna Platform for Payments”

Comments are closed.